If you want to see one of the best rollouts of a fairly complex business book, witness Michael Lewis’ extensive PR campaign for Flash Boys. He started with a “60 Minutes” exclusive where he said the “U.S. stock market is rigged”—not exactly earth shattering, but it got a debate going on Twitter among Wall St. columnists and other pundits. (Here’s a good one) The splashy “60 Minutes” debut then basically steamrolled into an all-day debate and coverage of high frequency trading on all of the business networks and the main networks (including CBS, of course). The New York Times had no less than four pieces from the book including an excerpt in the New York Times Magazine, a DealBook column by Andrew Ross Sorkin, an official review of the bookand a piece about all the hoopla. The Wall Street Journal had its own review and so did other major outlets. A search in Factiva yielded 385 mentions for the book in the last 24 hours, and that doesn’t include blogs. Then, a BNP Paribas executive wrote to all of his clients and told them Lewis was invested in IEX, the platform to combat high frequency traders that he wrote about. That prompted Lewis to issue a strong rebuttal on his Facebook page calling out the BNP executive by name. Twitter went nuts in the afternoon just as the whole Lewis frenzy was beginning to die down. BuzzFeed obtained a copy of the email (the post got 58,000 views in less than 24 hours), which fueled the fire even more. To top it all off, in a highly unusual move, the FBI reached out to media outlets to let them know they had been running an investigation of high frequency trading for over a year. AND THAT’S JUST THE FIRST DAY! The book is of course No. 1 on the Amazon Best Sellers list right now. By Zach Kouwe Zach Kouwe is a Vice President at Dukas Public Relations. By Zach Kouwe

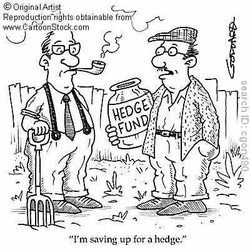

Numerous advertising executives have offered marketing advice for hedge funds hoping to expand their client base. Some key terms that are circulating amongst the experts are “transparency,” “access” and “performance.” Rob Reilly of Crispin, Porter & Bogusky said: “They have to find a way to be more transparent. They need to be honest and show how the money is made and how their process works.” He explained that although many hedge funds would find this disclosure unsettling, or even unmanageable, increased sharing contributes greatly to compelling marketing campaigns. Ads and campaigns in today’s industries are often extremely flashy and loud. Experts suggest that hedge funds find a healthy medium. “I wouldn’t invent talking babies or clever mnemonics; I’d be very straight forward about it,” explained Butler, Shine, Stern & Partners’ John Butler. For example, Mr. Reilly suggests that a firm broadcast a town-hall meeting on the official website, or even YouTube. The hedge fund’s executives could then publically answer questions from current, past, and potential investors.  By Zach Kouwe Despite news reports earlier this month that the Securities and Exchange Commission was poised to delay important changes to marketing rules for hedge funds and other alternative investment funds, the S.E.C. published proposed rules yesterday that will have a significant impact on how hedge funds speak to the public and market themselves to prospective investors. Both public relations professionals and reporters alike have quietly advocated for the loosening of these regulations, which have prevented hedge fund managers from talking publicly about their performance, investment strategies and even mentioning simple facts about their fund structure and fees. Now, if this new proposal becomes the law, more transparency will come to the hedge fund industry. Dukas Public Relations, which prides itself on transparent and open relationships between its clients and the media, will be submitting a comment letter to the S.E.C. in support of the proposed rule. (Our letter will be available here and via the S.E.C.’s website soon.) We believe this change will be welcomed by hedge fund reporters in particular, who often find it difficult to obtain simple information from hedge fund managers and the industry in general. Based on our conversations with clients and prospects, managers also support this change because most want to respond to reporters’ questions but fear running afoul of the rules. Even some managers who want to correct simple inaccuracies in the media can’t do so under the current regulations. While some hedge funds and marketing execs have talked of full-fledged advertising campaigns, we believe most firms will opt to ramp up their public relations initiatives rather than buy ads in print publications or sponsor sports stadiums. While not opposed to advertising, we think engaging with the media and the public at large is the best way for the hedge fund industry to become more transparent and better understood. As a PR agency for hedge funds, we look forward to seeing this proposed rule become law. |

Categories

All

|

|

Please see Terms of Use

|

RSS Feed

RSS Feed