|

By Zach Kouwe

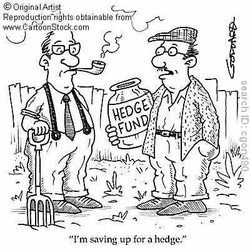

Numerous advertising executives have offered marketing advice for hedge funds hoping to expand their client base. Some key terms that are circulating amongst the experts are “transparency,” “access” and “performance.” Rob Reilly of Crispin, Porter & Bogusky said: “They have to find a way to be more transparent. They need to be honest and show how the money is made and how their process works.” He explained that although many hedge funds would find this disclosure unsettling, or even unmanageable, increased sharing contributes greatly to compelling marketing campaigns. Ads and campaigns in today’s industries are often extremely flashy and loud. Experts suggest that hedge funds find a healthy medium. “I wouldn’t invent talking babies or clever mnemonics; I’d be very straight forward about it,” explained Butler, Shine, Stern & Partners’ John Butler. For example, Mr. Reilly suggests that a firm broadcast a town-hall meeting on the official website, or even YouTube. The hedge fund’s executives could then publically answer questions from current, past, and potential investors.  By Zach Kouwe Despite news reports earlier this month that the Securities and Exchange Commission was poised to delay important changes to marketing rules for hedge funds and other alternative investment funds, the S.E.C. published proposed rules yesterday that will have a significant impact on how hedge funds speak to the public and market themselves to prospective investors. Both public relations professionals and reporters alike have quietly advocated for the loosening of these regulations, which have prevented hedge fund managers from talking publicly about their performance, investment strategies and even mentioning simple facts about their fund structure and fees. Now, if this new proposal becomes the law, more transparency will come to the hedge fund industry. Dukas Public Relations, which prides itself on transparent and open relationships between its clients and the media, will be submitting a comment letter to the S.E.C. in support of the proposed rule. (Our letter will be available here and via the S.E.C.’s website soon.) We believe this change will be welcomed by hedge fund reporters in particular, who often find it difficult to obtain simple information from hedge fund managers and the industry in general. Based on our conversations with clients and prospects, managers also support this change because most want to respond to reporters’ questions but fear running afoul of the rules. Even some managers who want to correct simple inaccuracies in the media can’t do so under the current regulations. While some hedge funds and marketing execs have talked of full-fledged advertising campaigns, we believe most firms will opt to ramp up their public relations initiatives rather than buy ads in print publications or sponsor sports stadiums. While not opposed to advertising, we think engaging with the media and the public at large is the best way for the hedge fund industry to become more transparent and better understood. As a PR agency for hedge funds, we look forward to seeing this proposed rule become law. Here's part of an interesting blog post by Richard Dukas, CEO of Dukas Public Relations, a financial PR firm in New York. It talks about hedge funds and other alternative investment firms beginning to open up to the media.

A recent article in the New York Times by Nelson Schwartz illustrates my point. Mark Lasry of Avenue Capital (not a client of Dukas Public Relations ) openly discusses his bet on a European turnaround. He talks about how much of his fund’s capital he’s investing, why and his return expectations. (On the same day, the Times ran a story about famed venture capitalist Marc Andreessen and his firm’s willingness to speak to the press despite being part of an industry that shuns it.) By Zach Kouwe

At long last, an arcane S.E.C. rule that has impeded PR people and reporters for some time appears to be on its way out. The rule, known as 502(c) of Regulation D, prevents anyone raising capital for a private investment fund, such as a hedge fund or private equity vehicle, to market or advertise to “non-qualified” investors, basically people with less than $1 million in net worth. In addition to a ban on traditional advertising, the rule means hedge fund managers have to be extremely careful not to actively solicit investors when speaking to the media. Most lawyers, who are generally conservative when dealing with S.E.C. rules, interpret this to mean that managers can’t discuss performance with the press and are forced to be generally cagey about their operations. In part, this has led to a hedge fund industry that has been described as “secretive” or “in the shadows.” If passed as part of the Obama Administration’s Jobs Act, which seems likely in early April, the S.E.C. would have 90 days to implement the changes. The Managed Funds Association, the hedge fund industry’s primary trade association, recently came out in favor of this change in a letter to the S.E.C. On the other side is the Investment Company Institute, the mutual fund and ETF industry’s primary trade association. In a February letter, they urged the S.E.C. not to change the rule, which they said would harm investors and could lead to scams that target unsophisticated investors. It will be interesting to see how the S.E.C. implements the law. However it comes out seems likely to change the way hedge funds and private equity firms communicate with the media and the public at large. Here’s Robert Kiggins, a lawyer at McCarthy Fingar, with his views on the law in Hedge Funds Review: “This is a potential game changer,” says Robert Kiggins, counsel at the law firm McCarthy Fingar. “Subject to the SEC rule-making, this means hedge funds can promote and market their products through mass media channels, from television adverts to newspapers articles and websites.”  By Zach Kouwe There’s been a lot of talk recently about pension funds being drastically underfunded. Some studies peg the funding gap for state and local pensions at more than $1 trillion. To make up the gap, pensions either have to force their members to contribute more, cut back on benefits or make it up by earning returns in the market. (Sounds like social security, doesn't it?) For now, it looks like pensions are turning to the market, specifically hedge funds, to boost returns despite less than stellar performance from the sector in 2011. Some states, like South Carolina, are actually cutting back their hedge fund allocations. But just over the border, North Carolina’s pensions system, which is pouring billions into the alternative space, is more emblematic of the rest of the nation. Some warn of dangers ahead if pensions try to juice their returns by taking on more risk. Others argue that even a modest allocation to hedge funds by pubic pensions could unlock $13 billion in annual returns and actually reduce risk by investing in assets that are uncorrelated to the market as a whole. It’ll be interesting to see who comes out ahead in the debate. But one thing we know for sure, pension funds are already lowering their return expectations -- a sign they don't expect huge returns from the market itself. Further reading – Pensions Investing with Fingers Crossed and Eyes Closed via CNBC.com (Op-ed from Mebane Faber of Cambria Investment Management) |

Categories

All

|

|

Please see Terms of Use

|

RSS Feed

RSS Feed