|

By Zach Kouwe

This week the Securities and Exchange Commission issued an update to their socialmedia guidelines regarding filing requirements under the Investment Company Act and other statutes. Overall, it appears the Commission wants to foster a more lenient regulatory environment on Twitter and other social platforms so investment companies aren’t stifled from using this new form of marketing and communication. The update makes clear that the sharing relevant links, stories, white papers and other non-fund-related things over Twitter and other platforms are exempt from filing requirements. Here’s an example of a Tweet that is acceptable: “Consumer Reports has written an article in which it mentions our ‘Brand X’ Rewards Card. Are you a member?” “The ‘Low Volatility Anomaly’ is explained in our latest white paper LINK” Even mentioning the word “performance” or sharing a link back to a website that includes fund performance data is exempt from filing requirements. Stating specific performance data in the communication still needs to be filed. (ie. Fund X achieved a 3 month return of XX%) These new guidelines should allow asset management firms and other investment companies more leeway to communicate and influence via social media. Many large alternative and traditional asset managers such as The Carlyle Group,Blackstone Group, Pimco, Blackrock and State Street are already using Twitter as a public relations tool to build their brands and communicate their thought leadership. (Pimco already has over 100,000 followers) While these large firms have the resources and extensive compliance departments to ensure adherence to the rules, these new guidelines make basic sharing of information on social media a much less burdensome activity. Every asset manager that aims to be an influencer in the community should be participating. By Zach Kouwe

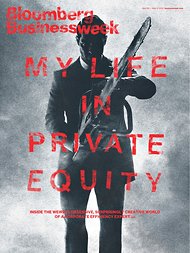

I recently stumbled upon a new survey of what institutional investors look for in their hedge fund managers. The survey, from fund administrator SEI, was particularly interesting because it covered what investors think about a particular firm’s “brand” identity and how that factors into their decision to invest in the fund. Not surprisingly, the results were mixed with many investors seemingly confused by the question. But from investors and consultants we've spoken to, having a solid and understandable brand in the market matters whether they admit it or not. From the survey: When we asked institutional investors to define “brand,” their answers diverged. Respondents were similarly torn on the importance of brand; one-third said it makes no difference in their selection of hedge funds, one-third disagree, and one-third are neutral. A hedge fund needs to able to describe its unique investment process in an understandable and concise way both to potential investors and the public at large. Take it from Bruce Frumerman, CEO of investment management industry communications and sales marketing consultancy, Frumerman & Nemeth Inc. from the survey: “You know your firm has graduated from commodity to brand when, after stating your fund’s name and strategy category, a prospect can add two or three sentences of elaboration about how you invest," he says. “If a hedge fund doesn’t actively market its investment- process story, it won’t outgrow being perceived as a replaceable commodity, known only by the pigeon-hole category of its strategy and its most recent returns." This can apply not just for hedge funds, but for any type of investment product or service. Money managers across the board, whether they manage institutional or retail capital, are becoming much more scrutinized. If they can't define their clear narrative, they won't be able to distinguish themselves. Hedge fund managers in particular can’t just sit back and rely on their track record – indeed the survey points out that investment performance is not even the most important factor when investors choose a fund. (This is already starting in the hedge fund world) “There are those who get it right, and gather billions in assets, and those with no idea of how to get their message across. They just use the same mumbled jargon and rarely convey what is actually happening. Marketers who think they don’t need to put it down on paper and convince others their process makes sense will get nowhere,” declared a managing director at a large European institutional investor. Our panelists also emphasized how important it is to spend the time and resources needed to make complex processes clear and simple. “Explaining simply just what it is you do is the single greatest feat for hedge funds,” said Michael Green, CEO, International with American Century Investments.  By Zach Kouwe “You never want a crisis to go to waste.” Those were the now-infamous words of Rahm Emanuel, the current mayor of Chicago and former chief of staff for President Obama, in 2008. In this election cycle, the private equity industry has been cast in a negative light by the media largely because of Mitt Romney’s background at Bain Capital. When other PE firms are trying to avoid getting sucked into the negative sentiment surrounding Bain, a relatively small and little-known firm has taken advantage of the opportunity by opening up to the media and telling its story. The firm, Monomoy Capital Partners, first opened up in a New York Times story in January, which profiled Oneida Ltd., a once iconic flatware company that had fallen on hard times. But the surprising thing was that Manhattan-based Monomoy injected new capital into Oneida and did a superb job detailing its plans to revive the company. The story even included this pithy quote from Oneida’s outgoing CEO: “They’re not Gordon Gekko,” he said of the firm. “It’s almost like they got together and said, ‘There’s a different way to do this.’” Monomoy took a risk opening up to the NYT – the story could have turned out negatively, like many other profiles of PE-backed companies. Instead, Bloomberg BusinessWeek picked up the story and, after Monomoy gave a reporter access to its two-week corporate boot camp for executives and partners, the magazine ran a cover story in its current issue on the benefits of private equity. The NYT’s Dealbook blog then followed up on Friday with a post calling Monomoy “the most popular private equity firm in town.” That’s what you call a PR grand slam and it’s all because of the firm’s willingness to open up when everyone else wouldn’t.  By Zach Kouwe Howard Marks, chairman of Oaktree Capital Management, is out with his latest letter to clients. This time, Marks felt compelled to write about the three-ring circus in Washington and the haggling over the debt ceiling. Bottom line: Marks believes we need a compromise now and the debt ceiling must be raised or the nation could face catastrophic consequences. He believes a compromise will eventually be reached, but, unfortunately, won’t bring fundamental change to the way our government manages its finances. Here’s the letter: |

Categories

All

|

|

Please see Terms of Use

|

RSS Feed

RSS Feed