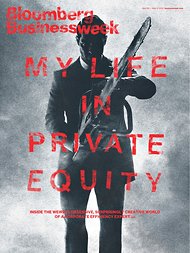

By Zach Kouwe “You never want a crisis to go to waste.” Those were the now-infamous words of Rahm Emanuel, the current mayor of Chicago and former chief of staff for President Obama, in 2008. In this election cycle, the private equity industry has been cast in a negative light by the media largely because of Mitt Romney’s background at Bain Capital. When other PE firms are trying to avoid getting sucked into the negative sentiment surrounding Bain, a relatively small and little-known firm has taken advantage of the opportunity by opening up to the media and telling its story. The firm, Monomoy Capital Partners, first opened up in a New York Times story in January, which profiled Oneida Ltd., a once iconic flatware company that had fallen on hard times. But the surprising thing was that Manhattan-based Monomoy injected new capital into Oneida and did a superb job detailing its plans to revive the company. The story even included this pithy quote from Oneida’s outgoing CEO: “They’re not Gordon Gekko,” he said of the firm. “It’s almost like they got together and said, ‘There’s a different way to do this.’” Monomoy took a risk opening up to the NYT – the story could have turned out negatively, like many other profiles of PE-backed companies. Instead, Bloomberg BusinessWeek picked up the story and, after Monomoy gave a reporter access to its two-week corporate boot camp for executives and partners, the magazine ran a cover story in its current issue on the benefits of private equity. The NYT’s Dealbook blog then followed up on Friday with a post calling Monomoy “the most popular private equity firm in town.” That’s what you call a PR grand slam and it’s all because of the firm’s willingness to open up when everyone else wouldn’t. Leave a Reply. |

Categories

All

|

|

Please see Terms of Use

|

RSS Feed

RSS Feed